maryland student loan tax credit amount

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by. Ad Complete Your App Today.

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Student Loan with Cosigner Are the Easiest to Get.

. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Multi-Year Approval Options Available. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount.

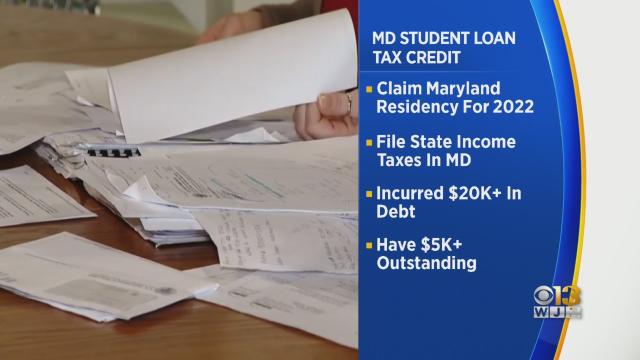

Use Our Website Pick Your Lender. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. You also must have at least borrowed 20000 in student loan debt and still have at least a 5000 outstanding balance upon applying for the tax credit.

Student Loan Debt Relief Tax Credit. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions. Who wish to claim the Student Loan Debt Relief Tax Credit.

Ad Use Our Comparison Chart Pick Between The Best Student Loan Rates Available. Maryland Student Loan Tax Credit Amount. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

To repay the credit. If the credit is more than the taxes you would otherwise owe you will receive a tax. About the Company Maryland Student Loan Debt Relief Tax Credit Award Amount.

With more than 40 million distributed through the. Should parents pay for college reasons for reasons not to money bliss parent pay college tuition loans for bad credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code.

Who How and When to Apply. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017.

Plan Long-Term with Our Multi-Year Approval Loan Options. All Maryland taxpayers who maintain Maryland residency for the past tax year may apply by. Student Loan Debt Relief Tax Credit.

Ad Complete Your App Today. The Student Loan Debt Relief Tax Credit Program. Plan Long-Term with Our Multi-Year Approval Loan Options.

Apply for a Loan with a Trusted Lender. The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit. CuraDebt is a company that provides debt relief from Hollywood Florida.

Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. It was founded in 2000 and has.

Multi-Year Approval Options Available. Apply for a Loan with a Trusted Lender.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Marylanders Encouraged To Apply For Student Loan Tax Credit

Learn How The Student Loan Interest Deduction Works

Net Worth Update March 2018 Future Proof M D Net Worth Emergency Fund Worth

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Learn How The Student Loan Interest Deduction Works

30 Americans Share Their Student Loan Debts And You Can Feel How Hopeless These People Are Student Loan Debt Student Loans Student Loan Forgiveness

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Indiana Mississippi And North Carolina Will Tax Your Canceled Student Loan Debt Cnet

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wjla

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

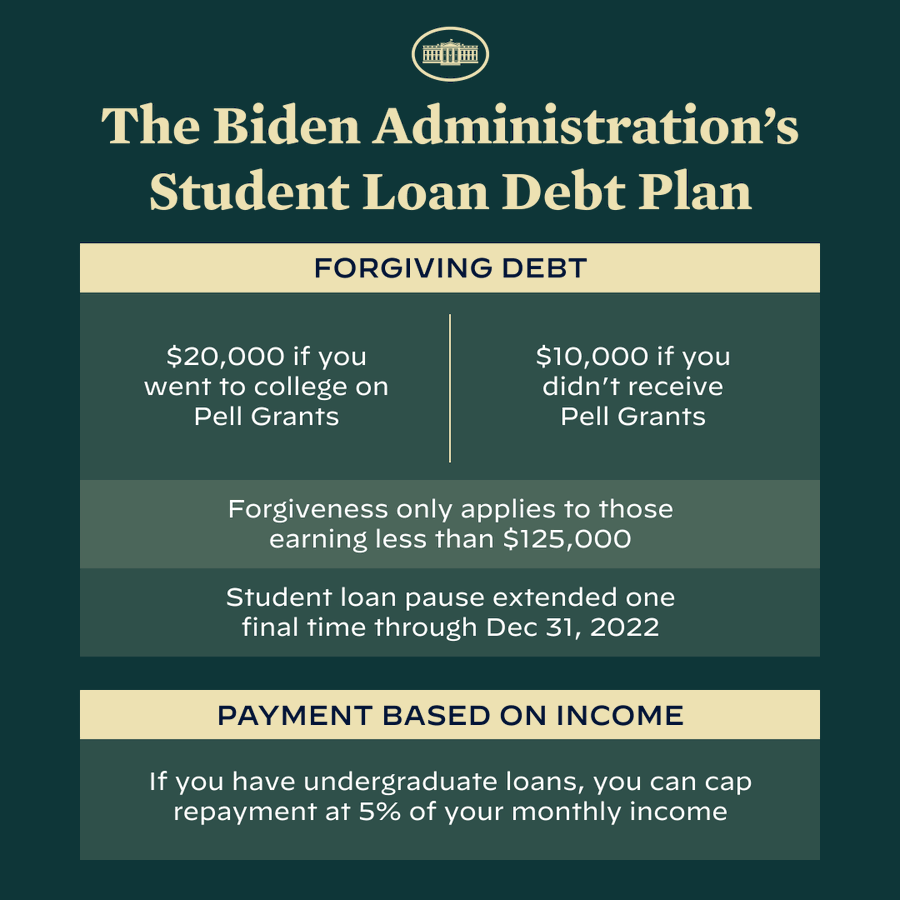

Student Debt Relief Who Qualifies For The Biden Administration S Plan To Cancel College Loans Phillyvoice

Current Student Loans News For The Week Of Feb 14 2022 Bankrate